The Africa Centre for Energy and Mineral Policy (ACEMP) is a Non-Profit Organisation that was founded in 2012. In the last 5-10 years we have partnered with the African Centre for Media Excellence (ACME) to train both print and radio journalists about the extractive industries, oil, gas and mineral sector in order to improve their reporting on the nascent petroleum and minerals resources in Uganda. Indeed, some have excelled and gone on to apply these skills at the nation’s leading print media, including this very paper.

However, lately Uganda has been cast in the limelight for some unfortunate resource misreporting about the status of our mineral wealth. One was the recent state of nation’s reporting about 31 million tonnes of gold discoveries in the country and this has since been followed by another misreporting of rare earth elements discoveries to the tune of 532 million tonnes in Bugiri, Bugweri and Mayuge Districts in Eastern Uganda worth $350 billion. In all the two media reports, we are neither informed as to whether these discoveries are resources or reserves, a critical element in resource evaluation, classification, and reporting.

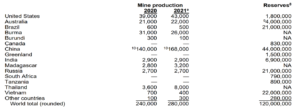

Current global rare earth elements annual production by the leading top 10 producers of rare earth elements in the world. In 2021, China was at the top with 168,000 metric tonnes, the U.S, 43,000 metric tonnes, Mynamer 26,000 metric tonnes, Australia, 22,000 metric tonnes, Thailand, 8,000 metric tonnes, Madagascar, 3,200 metric tonnes, India, 2,900 metric tonnes, Russia, 2,700 metric tonnes, Brazil, 500 metric Tonnes and Vietnam, 400 metric tonnes. This information is important because these are mere annual productions registered in 2021 for the top 10 producers of rare earth elements in the world.

World Rare Earth Elements Country Production and Reserves for 2021 (Data in Metric Tonnes)

Source: U.S Geological Survey, Mineral Commodity Summaries, January 2022.

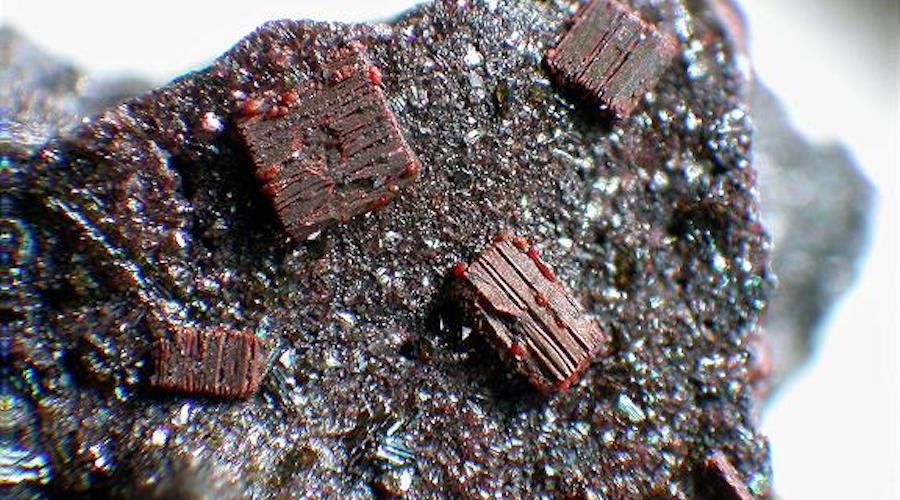

Rare Earth Elements are known for their respective individual qualities that funnel them into specific use cases and markets. From lighting and optics to electronic displays to permanent magnets and guidance systems, each use requires a different element or different combination of elements. Further still, not all rare earth elements are found in the same types of deposits; they occur in different places and in different concentrations. Rare earth elements are typically categorized into two sub-groups based on weight: light rare earth elements (LREE) and heavy rare earth elements (HREE). Demand for these resources is forecast to continue to increase in the coming years as the world undergoes an energy transition from fossil fuels to the adoption of a greener and more climate friendly renewable and alternative source of energy.

Source: USGS

At 44 known million metric tonnes above, China retains near monopoly on the global supply of rare earth elements in as much as it controls the processing steps that remove the elements from the rest of the rock in which they are found. This control and monopoly over the processing technology presents not only a global supply risk, but also limits capabilities of developing critical mineral rich economies like Uganda capability to domestic value addition and development of these resources so as to tap into the wide range benefits associated mineral beneficiation and value addition, such as employment of its youth and maximisation of fiscal benefits that these resource present in terms of revenue maximisation.

Tabloid style resource reporting as exhibited by some respected national print media with a wider international readership is not only embarrassing to the nation but also sends wrong signals to the policy makers in government. For example, it was reported in the Uganda media recently, that the prime minister had stopped the investors of the Mukutu Rare Earth Project insisting that development of these resources should follow government’s policy on value addition, while local politicians are already visualising ‘Dubai monumental skyscrapers’ for their electorate, which calls for management of both state and community expectations.

The other wrong signal from such reporting is the assumption that these discoveries are proven commercial reserves whereas not. Classification of mineral resources is not only critical to investors, attraction of FDI in the mineral sector, but also very important for policy makers in informing their policy decisions and direction. It is therefore important to always be specific when reporting these discoveries to avoid misguiding the public and most importantly the policy makers. The starting point is always to differentiate between resources and reserves as illustrated below.

Classification of Mineral Resources and Mineral Reserves

A “Proven Mineral Reserve” is the economically mineable material derived from a measured mineral resource. A “Probable Mineral Reserve” is the economically mineable material derived from a measured and/or Indicated Mineral Resource. A “Mineral Reserve” is the economically mineable material derived from a measured and/or indicated mineral resource.

A “Proven Mineral Reserve” is the economically mineable material derived from a measured mineral resource. A “Probable Mineral Reserve” is the economically mineable material derived from a measured and/or Indicated Mineral Resource. A “Mineral Reserve” is the economically mineable material derived from a measured and/or indicated mineral resource.

A “measured mineral Resource” is that part of a mineral resource for which tonnage densities, shape, physical characteristics, grade and mineral content can be estimated with a high degree level of confidence. An “indicated mineral resource” is that part of a mineral resource for which tonnage, densities, shape physical characteristics, grade and mineral content can be estimated with a reasonable level of confidence. An “inferred mineral resource” is that part of a mineral resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. A “Mineral Resource” is a concentration or occurrence of material of economic interest in or the Earth’s crust in such form and quantity that there are reasonable and realistic prospects for eventual economic extraction.

So here is what we know from Rwenzori Rare metals Limited and Australian Stock Exchange Listed Ionic Rare Earths, two of the companies behind this discovery. Available data shows that these resources may not necessarily meet all the credentials for value addition in country as our policy makers may wish. Data from Rwenzori Rare Metals indicate resources of 532 million tonnes (comprising of inferred, indicated, and measured resources) @ 640 parts per million Total Rare Earth Oxide (TREO), which means that there is potentially a maximum of 340,000 metric tonnes of commercially mineable rare earth oxide.

The potential value of the entire known mineable resource base is around US$ 16 bn at current market value, which is way below the reported US$370 billion and nowhere near the value of Uganda’s oil and gas resources, but nevertheless a significant value for our economy. The company also plans to develop an operational open pit mine by 2024 with a gradual ramp up to mining of approximately 4,000 metric tonnes per annum over the ensuing 3-year period, before considering further development and expansion of the project if necessary. This would place Uganda amongst the top 10 global producers of rare earth elements in the world and guarantee the developer adequate raw materials for the estimated modelled 50 years or more lifetime of the mine.

However, to demand for value addition as propagated by government without a full appreciation of the characteristics of our minerals, global market dynamics, and other variables such as access to technology, CAPEX and OPEX implications and other geopolitical issues continues to discourage and frustrate investors in our mineral sector and risks in this case rendering this rather important project for the country and communities in the Busoga region, uneconomical and a race to the bottom. It is important therefore for all stakeholders, the mining companies involved, local communities, cultural and political leaders in the Busoga region as well as government technocrats to pick interest in this important discovery in order to manage both national and community interests.

Bwesigye Don Binyina

Mineral and energy economist

Executive Director,

Africa Centre for Energy and Mineral Policy (ACEMP)

+256772512460